EOFY

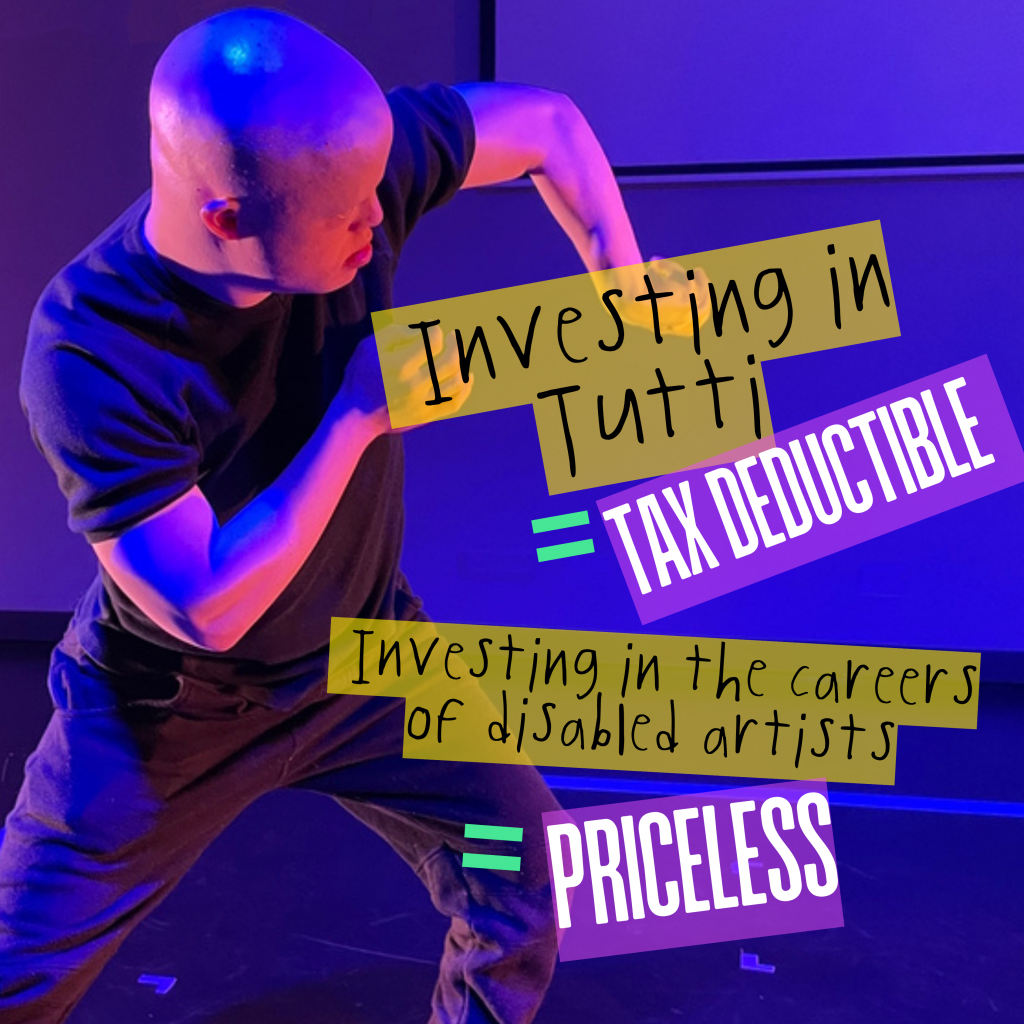

End of financial year (EOFY) donations can do more than reduce your tax. You can invest in creative career development for local learning disabled and neurodivergent artists.

As you reflect on EOFY, give with purpose and make a donation that shines light on disabled talent, change makers, and thinkers, deepening the creative richness of the arts.

Tutti Arts is a registered Deductible Gift Recipient making your donation tax-deductible, so you’ll save on your next tax return. More importantly, your support helps create lasting change, by challenging the narrative of disability and showcasing disabled creative excellence, in visual art, music, theatre, radio, film and dance.

What are EOFY donations?

Charitable donations of $2 or more made before midnight on 30 June may be tax-deductible. In Australia, eligible donations made to a registered Deductible Gift Recipient (DGR), including Tutti Arts, can be claimed as a deduction on your tax return. You can read more about this on the ATO website.

EOFY donations to Tutti Arts can help reduce your taxable income (so you’ll pay tax on a lower income), while supporting the careers and creativity of learning disabled and neurodivergent artists, filmmakers, actors, dancers and musicians.

To qualify, your donation must:

- Be made before 11:59 pm AEST on 30 June

- Be to an organisation with DGR status (like Tutti Arts)

- Be a true gift, not a contribution (you don’t receive anything in return)

- Have a receipt or proof of the donation

EOFY giving is a powerful way to investing in more creative and imaginative contemporary arts. Your generosity helps create real, lasting change, opening doors for disabled artists to dream and to enrich our world with their unique perspectives.

Where the money goes

Creative excellence takes craft, patience, commitment and confidence, the difference you can make at an individual and societal level is profound.

- $50 buys a set of 16 acrylic artist pens (POSCA), one of the most in demand items in our visual arts lab.

- $200 pays for six professional microphone stands to help our performances and our disabled artists be heard.

- $750 could cover the entry fees for national arts prizes, shipping and framing costs for visual artists.

- $2000 could enable interstate or cross-cultural residencies or pay professional mentors for our visual artists, for example.

- $5000 could allow us to invest in a new camera for our Screen artists to keep making more award-winning films. Check out Sit down, shut up and watch if you are interested in this area in particular.

- $25,000 could fund research and script development for new plays for ensemble theatre or touring costs for musicians. Or it could unlock further support, allowing us to approach other donors with match funding proposals.

Whether it goes towards professional headshots, recordings, artist materials, technical equipment or the incredible Tutti team who work with our artists, your support makes a real impact, so thank you!

Tutti is also funded by Creative Australia and Create SA (formerly Arts SA). We work in close partnership with some of Australia’s leading arts organisations, including the Access 2 Arts, Art Gallery of South Australia, Adelaide Festival, Adelaide Festival Centre, Adelaide Symphony Orchestra, Adelaide Film Festival, Artlink, Fringe Festival, Carclew, South Australian Museum, Perth International Cabaret Festival, Post Office Projects Gallery + Studio.

EOFY tax tips for smarter giving

The end of financial year (EOFY) is the perfect time to check your receipts, review your giving and see what you can claim. Make sure you enjoy the tax benefits of donating with these four simple tips.

- Donate before 30 June. To claim your donation in this year’s tax return, you’ll need to give before the end of the financial year. Even small last-minute donations can add up.

- Set up monthly donations. Regular giving is easy to forget about when completing your tax return, but it adds up and is worth counting at tax time. Tutti can send you a tax summary around EOFY to simplify claims.

- Keep your receipts. Save your email confirmations. If you’re ever audited by the ATO, you’ll need to show proof of donation.

- Plan ahead. EOFY giving doesn’t have to be rushed. You can talk to Tutti at any time about making a donation to make tax time easier and more rewarding.

How EOFY donations can help your taxes?

EOFY donations are not an instant refund, but they can reduce how much tax you pay.

When you lodge your tax return, you can claim any eligible donations made during the financial year. These donations lower your taxable income, so you’ll pay tax on a smaller amount.

For example, if your income is $80,000 and you donate $2,000 to Tutti Arts, you may only be taxed as if you earned $78,000. Please note that the actual benefit depends on your income and marginal tax rate.

The principle is simple: the more you give (within your means), the less tax you may owe.

You can choose where your income goes, towards tax or towards creating more inspiring and inclusive arts for us all to enjoy!